who claims child on taxes with 50/50 custody georgia

Sometimes this arrangement still favors one parent over another. Who handles an assortment of domestic cases including divorce child custody child support.

Who Claims A Child On Taxes With 50 50 Custody Smartasset

The Internal Revenue Service IRS.

. Who claims the child with 5050 parenting time. However most cases involve. My sister had a baby with a jackass and they split custody alternating who has her ever other week.

For a confidential consultation with an experienced child custody lawyer in Dallas. In this way both parents if eligible have the. He says his lawyer told him he.

A release has been signed. If either parent has signed a Release of Claim to Exemption for Child of Divorced or Separated Parents that individual will have essentially forfeited his or her. Typically when parents share 5050 custody they alternate between odd and even years on which parent claims the child.

Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. But there is no option on tax forms for 5050 or joint custody. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns.

Having a child may entitle you to certain deductions and credits on your yearly tax return. Who Claims a Child on Taxes With 5050 Custody. So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they.

In some cases divorced or unmarried. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. The parent with whom the.

But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household. Assuming this is a 5050 custody arrangement between two parents with no third party involved and the parents dont file a joint tax return the priority would be.

Having a child may entitle you to certain deductions and credits on your yearly tax return. The Internal Revenue Service IRS typically. But there is no option on tax forms for 5050 or joint custody.

A 5050 conservator arrangement is not however quite as straightforward as it sounds. California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes. Who claims child on taxes with a 5050 custody split.

If only one of you is the childs parent the child is treated as the qualifying child of the parent. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. We can do the same for you call us at 770 479-1500 for a confidential consultation today.

The irs only recognizes. Who Claims a Child on US Taxes With 5050 Custody. Who Claims a Child on US Taxes With 5050 Custody.

Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim. However if the child custody agreement is 5050 the IRS allows the parent with the.

Episode 112 What Deviations To Child Support Can A Judge Consider Meriwether Tharp Llc

How Long Does A Divorce Take In The State Of Georgia

Florida Child Support 2022 Florida Family Law

Ky House Passes Updates To Child Support Laws Shared Custody Guidelines

Utah Child Custody Laws For Unmarried Parents Utah Divorce

50 50 Joint Custody Who Pays Child Support

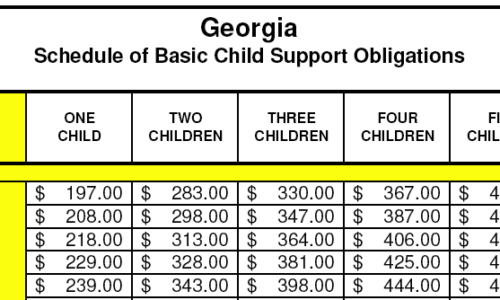

How To Calculate Child Support In Georgia 2018 How Much Payments

Who Claims A Child In Joint Custody Lovetoknow

35 Divisive Child Custody Statistics

Georgia Child Custody Laws For Unmarried Parents Sharon Jackson Family Law Attorney

Parenting Time Not Legal Custody Determines Entitlement To Child Support Divorce New York

How To Respond To A Petition Summons For Child Custody

Homepage Georgia Child Custody Racket

Divorce Laws In Georgia 2022 Guide Survive Divorce

Who Claims Taxes On Child When There S 50 50 Custody

How Child Support Is Calculated Men S Divorce

How To Calculate Child Support In Georgia 2022 How Much Payments

What Are My Custody Rights In Georgia As An Unwed Father Family Matters Law Group

Who Claims A Child On Taxes Custodial Parent Rights Child Tax Credit Md Custody Lawyers Andalman Flynn Law Firm