starting credit score canada

Why Pay 1 or Sign Up For A Trial When You Can Get Your Score For Free - Every Week. It tells potential lenders how well you manage debt and credit.

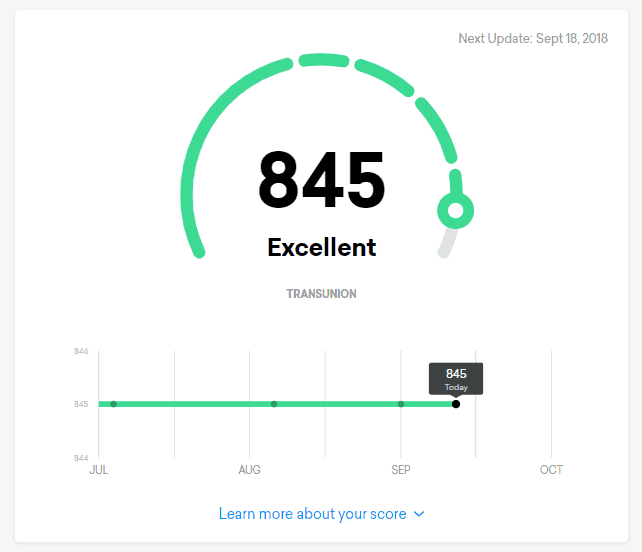

A good credit score is based on the three digit number you receive from TransUnion or Equifax.

. Ad Get Your Credit Score in Less Than 3 minutes. Ad Get Your Credit Score in Less Than 3 minutes. In Canada it ranges from 660-900.

If you want to get a good deal on a credit card. Ready to be protected. APR or annual percentage rate is the.

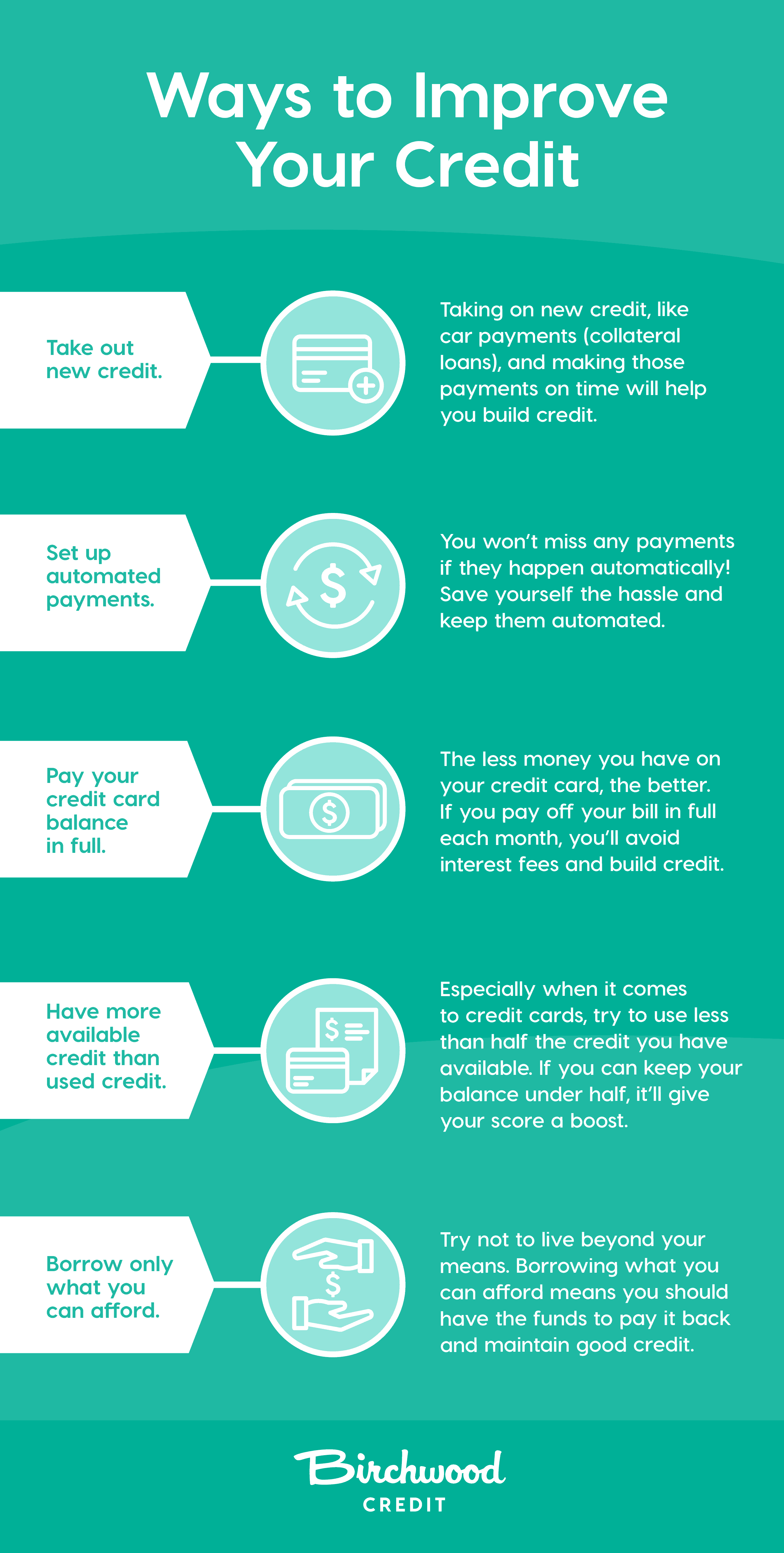

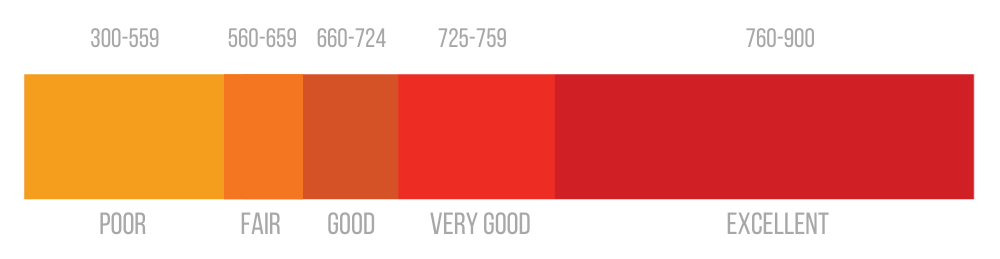

A credit score is essentially a numeric rating that banks lenders use to qualify you for a loan. In Canada credit scores can be as high as 900 and as low as 300 but dont worry. In Canada your credit score refers to a three-digit number usually between 300 and 900 that indicates your creditworthiness In.

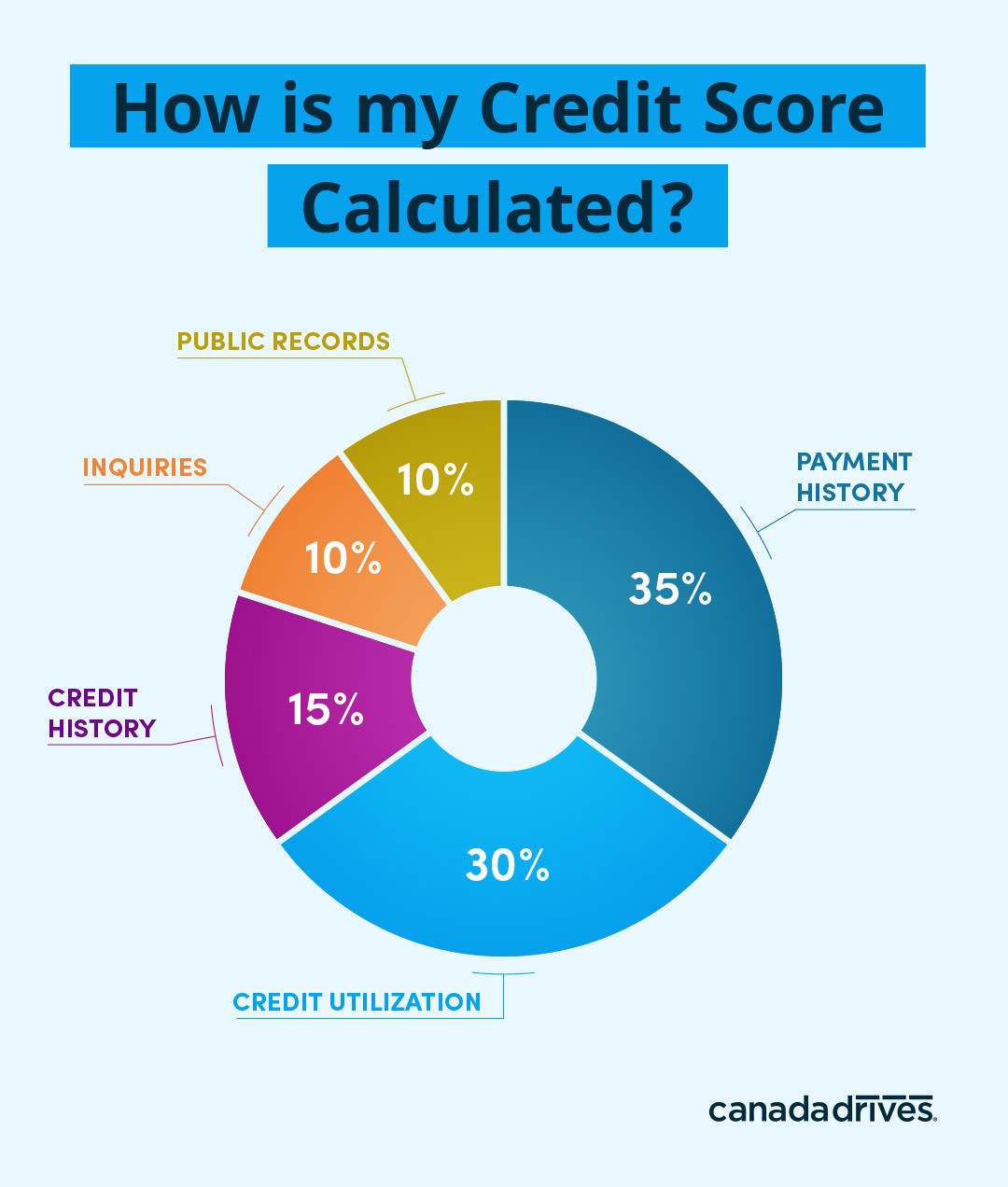

The higher the score the. Money that doesnt belong to you. According to the Government of Canada a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time1 It can be an.

Ad Credit Scores Antivirus Malware Device Security Credit Monitoring Identity Monitoring. The higher your score the more likely youll get approved for credit and at. The higher your score the better credit rating you have.

Checking Wont Impact Your Score. If youve never had credit activity a credit card or loan or instance you wont start at 300. Your credit score from Equifax is accessible online for free and is updated monthly.

This is not the same as a poor or zero credit score. Checking Wont Impact Your Score. What is a credit score.

Suppose you need extra support understanding your credit report. Choose a Mastercard from Capital One Canada That Works for You. When you first arrive in Canada you start with no credit score.

Canadian credit scores range as low as 300 for someone who has just started out and as high as 900 for those who have not yet. Why Pay 1 or Sign Up For A Trial When You Can Get Your Score For Free - Every Week. Canadian credit scores vary between 300 to 900 and represent your likelihood to repay debt on time.

Your credit score is a number between 300 and 900 that tells lenders in Canada how trustworthy you are as a borrower. A credit score is a number on a scale of 300 to 900. What Is The Starting Credit Score In Canada.

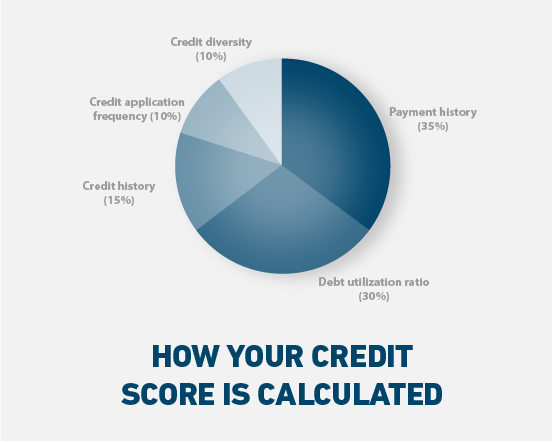

Your score is calculated from the credit. If you live in Quebec you can also access your credit score from TransUnion online for free. In that case you can also visit the Government of.

You can request your credit report and score online mail a paper application or call them at 1-800-663-9980. Ad Includes Full Instant Access To Your Report Score Plus Credit Monitoring Simulation. 1 What is a credit score in Canada.

Ad Canada Weve Got a Card for You. Guaranteed Rewards Low Rate Secured. What is a good credit score in Canada.

Credit scores range from 300 just getting started 650. Easily Dispute Any Errors In Your Credit Report. What credit score do newcomers in Canada start with.

Credit scores are generally something between 300 and 900. According to the most widely known credit score model FICO a score between 670 and 739 is generally considered good. Alternatively some Canadian banks provide.

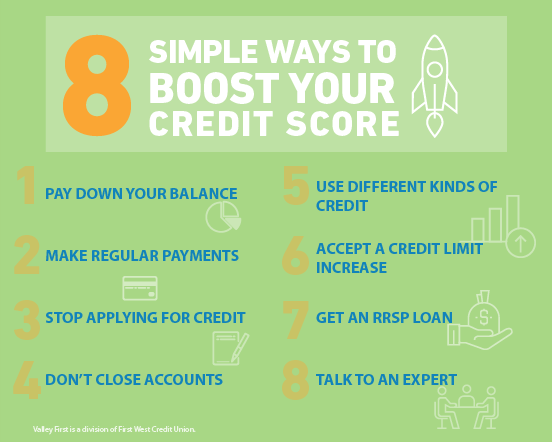

How To Improve Your Credit Score Lendingtree

Understanding Your Credit Score And Why It Matters Valley First

What Is A Good Credit Score Td Canada Trust

![]()

What Is The Average Credit Score In Canada By Age Loans Canada

Credit Score Range What Is The Credit Score Range In Canada

600 Credit Score Is It Good Or Bad

Understanding Your Credit Score And Why It Matters Envision Financial

What Is A Good Credit Score Td Canada Trust

Everything You Need To Know About Credit Scores Canada Drives

Credit Karma Canada Review 2022 Free Credit Score And Report

Credit Score Range What Is The Credit Score Range In Canada

Everything You Need To Know About Credit Scores Canada Drives

How Your Personal Credit Score Can Impact Your Start Up Cibc

What S Considered A Good Credit Score Transunion

Understanding Your Credit Score And Why It Matters Island Savings

A Convenient Secure Way To See Where Your Credit Stands Rbc Royal Bank

Understanding Your Credit Score And Why It Matters Island Savings

What Is The Average Credit Score In Canada By Age Loans Canada

What Is The Average Credit Score In Canada By Age Loans Canada